Lending to the retired – Exclusive research on one of the fastest growing mortgage sectors.

Our latest residential property market report is absolutely packed with research. Leading the analysis, Rob Thomas (a former Bank of England economist) has provided full economic commentary throughout. That includes an in-depth look at the specialist mortgage market, and which sectors are set for growth.

In the report, we discuss the changing demographics of UK society, and the impact of those changes on the general and specialist lending sector. With an aging UK population and socio-economic factors pushing the age of borrowing steadily upwards, lending to the over 65s and the retired has quickly become one of the fastest growing areas.

In fact, Rob Thomas suggests that the sector could increase by as much as 126% between 2023 and 2029. Let’s take a deeper look at why lending to the retired is set for such as meteoric rise.

Growing population

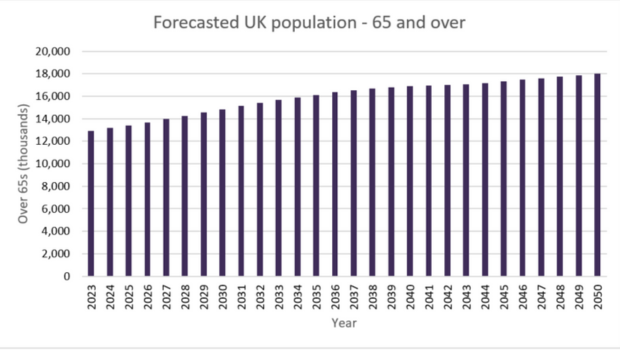

One key reason for the increase in lending to over 65 year olds is simply that there will be more people in that age group. In his in-depth economic summary, Rob reveals that government projections for the UK population show the demographic is estimated to rise from 12.7 million in 2022 to 14.6 million in 2029.

Moving further into the future, the projections show a continued increase into the 2030s and beyond, with an estimated 15.9 million people in the age bracket by 2034 and over 18 million by the middle of the century.

ONS, Principal projection for the UK - population by five-year age groups,

2021-based interim edition

Affordability

The cost of living crisis has had a dramatic effect on a large swathe of UK society, causing issues for first time buyers, renters and homeowners alike. Runaway house prices, increasing monthly bills and higher borrowing costs have not only made it harder for buyers to meet affordability criteria, it’s also meant that it’s taking longer to save for deposits. It’s pushed up the age at which people can initially afford to buy and how long they take to pay back their mortgage.

For example, the average age of a first time buyer is now widely recognised to be roughly 33 – 34 years of age, but there’s also been a significant rise in the number of 56 to 65 year olds enquiring for their first property (Legal & General Mortgage Solutions reported a 13% increase in the first quarter of 2024 compared to 2023).

For more insights, research and opinions on how changing buyer demographics have shaped and challenged the modern-day mortgage market, read our residential property market report 2024 / 2025.

We’ve collated expert analysis from around the industry and results from nationwide surveys to provide you with the most up to date look at the residential landscape and the road ahead.

Longer mortgage terms

The rise in longer mortgage terms, often used to offset high monthly mortgage repayments, also means that people are paying close to or into retirement. The Financial Conduct Authority concluded that mortgages lasting over 30 years made up 35% of sales in 2023, highlighting that a 33 year old first time buyer would be 63 or over by the time they complete their mortgage term.

At Together, our regulated first charge mortgages range from 3 years up to a maximum term of 40 years, giving customers flexibility and choice.

Five-year forecast

At the start of this blog, we mentioned that Rob Thomas forecasts a 126% growth in lending to the retired between 2023 and 2029, but let’s break it down so you can see the numbers.

Forecasted lending to retired - £ millions

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

|---|---|---|---|---|---|---|

| 615 | 668 | 720 | 837 | 1,067 | 1,284 | 1,391 |

Source: Rob Thomas

The table above highlights that lending to this segment of the market is set to become a billion-pound industry within the next two to three years, averaging 14.6% compound annual growth as we approach the end of the decade.

Survey results

As well as the in-depth economic analysis and forecasting provided by Rob, our residential property market report also includes the results of several surveys conducted by Censuswide and Opinium on people’s attitudes to borrowing.

We’ve delved back into the results to bring you exclusive research on the specific trends and attitudes of the 55+ age group.

- 41% of over 55 year olds affected by mortgage rises said they’d seen their mortgage payments increase by between £100 and £200 per month.

- For three quarters (78%) of over 55s with a mortgage, it’s been over 10 years since they last successfully took out or renewed a mortgage.

- 35% of those aged 55+ said that a checklist of supporting documents (with guidance on where to find them) would improve their mortgage application experience.

- On average, over 55 year olds have seen their monthly household expenditure increase by £261.42 since the start of the high rate environment.

- 28% of the demographic said that providing more social and affordable housing should be on the Labour government’s highest priority regarding the housing market.

- Downsizing was a more popular reason given by over 55s planning to move within the next 12 months (34%) than buying a larger property (20%).

Rob Thomas explains…

“Lending to the retired is a specialist segment that is affected by the changing nature of the economy and housing market. The persistence of high house prices relative to incomes over the past two decades has led many people to delay the purchase of their first home until later in life. It has also encouraged many borrowers to extend the term of their mortgage to make repayments more affordable.

Data from the Bank of England show that 42% of mortgages advanced in the fourth quarter of 2023 had an end date beyond the borrower’s expected retirement date, up from 31% two years earlier.

These changes have left many more homeowners with mortgages extending into retirement and when they come to remortgage these products, affordability will need to be assessed based on the borrower’s retirement income rather than the earned income typically used with mainstream mortgages.”

Rob provides his expert analysis and forecast on much more than just lending to the retired as part our latest report.

Find out what he has to say on self-employment, house prices, interest rates, and more.

At Together, we have a common-sense approach to lending, especially when it comes to helping customers that are retired (or approaching retirement age). That means that we don’t simply reject them once they cross a maximum age and we’ll take their whole income in to account when looking at affordability, including benefits, equity and inheritance.

Our team are always here to help you get the very best outcome for your clients. If you’ve seen an increase in the number of older or retired clients struggling to find finance that fits their lifestyle, get in touch with our Intermediary team to see if we can provide a specialist solution.

If you’re finding it hard to access finance to fund your property aspirations in later life, find out if we can provide a specialist solution.

Get in touch