Commercial Finance Packaging: a guide to income and affordability.

To help ensure we have the right information when you’re submitting a case, we’ve created a simple guide on our requirements when assessing a customer’s income and affordability.

Total Secured Debt Income (TSDI) calculation

This is the calculation we use for Commercial term, Holiday lets and serviced bridges. This is the customer’s current secured debt payment per month and their new Together secured loan, divided by their monthly income.

e.g £500 current secured debt payments + new loan £499.27 divided by their £2k income = 50% TSDI

Please note existing secured debt payments must factor in any residential payment and any non-self funding Buy to Lets or secured debts.

Don’t forget to update MBV once the income is provided.

Please upload a screenshot of your calculation on MBV once the income is provided for the Commercial Term, Holiday Lets and serviced Bridging cases.

Commercial term calculator

Proof of Income

Self Employed

- Tax calculations and tax year overviews (this is evidence that tells us the correct amount of tax for the financial year – this is very important to send us). Please ensure this shows name, Unique Tax Reference (UTR) and NET income.

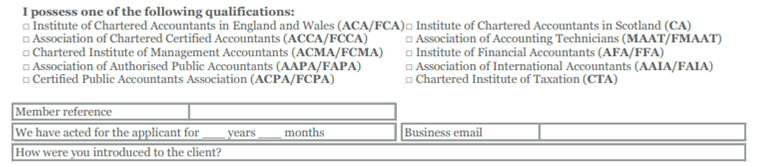

- Accountants Reference (see reference for accepted qualifications below).

Please ensure all sections are completed and the document is signed and stamped by an accountant. - Accountant explanation required in additional comments if projection is higher than certified figures.

Employed

- If paid monthly/four weekly/fortnightly, we require 2 of the last 3 months payslips.

- If paid weekly, we require 4 of the last 3 months pay slips.

- If paid in cash we require an employer’s reference. We also require a reference if insufficient payslips are available.

- If applicant is employed by a family business, a letter from the company account is required to support payslips received.

Assessing affordability

Buy to Let

If Shorthold Tenancy Agreement (AST) is not in place on completion, only 90% of estimated rent is used in the ICR calculation.

125% ICR for basic rate tax payers and Limited company applications/145% ICR for higher and additional rate tax payers.

Top slicing is available if ICR is not met – full affordability assessment will be carried out on MBV.

Please note, Buy-to-let top slicing cases where the LTV is over 60% will be on a referral basis, this will enable our underwriters to take a closer look at the case.

This change is to support customers who may be supplementing rental income with their background income.

How do I refer the case?

You can refer your case via MBV using the ‘Refer Application’ button on the case summary screen. Please ensure you fill in as much information as possible prior to referring your case, so that our underwriters have all the information needed when reviewing your case.

Do I need to submit any documents with my referrals?

As per our standard referral process, you don’t need to submit any additional documentation, however, if you have any information that you feel may support the underwriter in reviewing your case, please provide this information.

Ensure commitments are keyed correctly, security mortgages must remain as a commitment if keying gross rental figure.

Commercial Investment

If the security is let - 120% ICR coverage, if this fails revert to TSDI calculation.

Trading Commercial Business

Total Secured to Debt Income ratio must be no more than 50%-60%. You may refer a case to your BDM or Roving Underwriter if the TSDI calculation is >50% utilising evidenced net income.

Home Owner Business Loan

- Full automated affordability assessment.

- Securing against the customers residential so we must ensure the customer can afford this due to the risk their home could be repossessed.

Holiday Let

- Total Secured to Debt Income ratio must be no more than 50%-60% (Refer > 50%).

- Up to 50% of Holiday Let projections used towards affordability – evidence with Letting appraisal or accountant reference if currently owned.

We have a dedicated team of experts who are here to support you in realising your clients’ property ambitions. Get in touch with us today.