175k bridging loan provided within 10 days saves retirees dream move.

When her sister sadly passed away, Dorothy wanted to use the inheritance left to her to move from her second floor flat in Orkney to a beautiful £270,000 bungalow, just miles down the road.

The idea

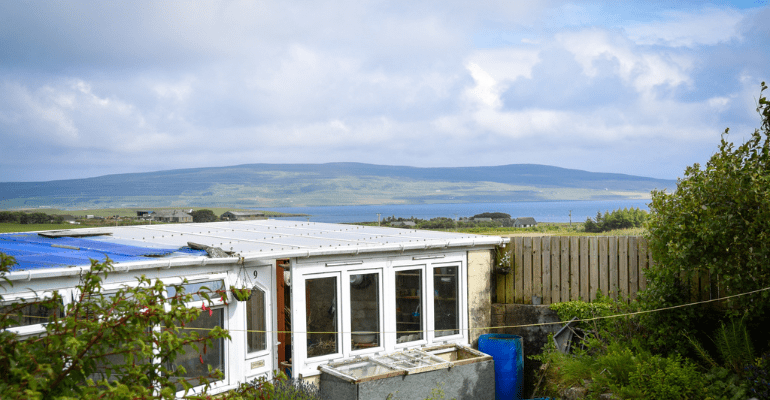

After her sister passed away, Dorothy decided it was time for a change. That change would be moving out of her second floor flat in Kirkwall, Orkney, and into a home better suited to her needs. Having entered a private sale with a friend, Dorothy wanted to use the inheritance left to her to purchase a beautiful bungalow just a few miles away, with a spacious garden and stunning sea views.

As a retiree, the importance of accessibility around the home had heightened in recent years, especially as walking up two flights of stairs every day had become increasingly difficult. The purchase of this single-floor house, which her friend had already planned on selling, was her perfect living situation.

The enablement

Time was of the essence. But Dorothy’s inheritance had not come through yet, as it was tied to the sale of her sister’s house.

The delay threatened to derail her own move as well as her friend’s. Now, both Dorothy’s purchase and her seller’s onward house move were in jeopardy as they were both stuck in the chain.

As completion day fast approached, Dorothy reached out to her financial advisor for help and they soon realised her situation needed speed and a common-sense approach. That’s where Together came in.

Dorothy’s story is one of many that we have included in our latest residential property market report for 2024/2025.

Take a look at the roadmap ahead for residential home movers like Dorothy.

The result

Dorothy got in touch with Together, and the documents on the single security bridge were requested on the same day. By the next working day, her case was being assessed and submitted to an underwriter, taking into account the inheritance money that was coming to her.

Together were able to provide a £175,000 bridging loan, for the purchase of the bungalow. Dorothy shared her feelings on the transaction saying, “Together took just 10 days to provide the funds I needed. I was blown away by the super service they provided and felt supported every step of the way with daily phone calls. It was a rollercoaster, but I am very happy in my new home!”

With the support from Together, Dorothy was able to move into her new dream home, with the peace of mind that she could repay the loan in full once the inheritance had settled.

Want to find out more about bridging loan finance?

Bridge the gaps in your knowledge by taking a look at our ‘From A to Buy: Ten frequently asked bridging finance questions’ blog.

Bridging finance might be the perfect option if you find yourself stuck in a chain that’s about to break. Take a look at the options available to close on the property of your dreams.

If you’ve spotted a great residential opportunity that won’t wait, find out more about bridging finance; because you shouldn’t miss out on your ambitions just because your money’s tied up.

Similar Articles

-

Bridging loans: 9 ways short-term finance gets you from A to Buy

7 minPersonalBusinessIntermediariesBridging Loan -

What does ‘Gazumping’ and ‘Gazundering’ mean?

5 minPersonalBusinessIntermediariesBridging Loan -

The Manchester mum who turned a side hustle into thriving Buy to Let portfolio

3 minBusinessBuy to LetBridging LoanAuction Finance

Any property, including your home, may be repossessed if you do not keep up repayments on your mortgage.

All lending decisions are based on lending criteria and, where applicable, subject to credit check and an assessment of individual circumstances.

All mortgages are subject to our terms and conditions.

Loans offered by Together Commercial Finance Limited are not regulated by the Financial Conduct Authority.

Articles on our website are designed to be useful for our customers, and potential customers. A variety of different topics are covered, touching on legal, taxation, financial, and practical issues. However, we offer no warranty or assurance that the content is accurate in all respects, and you should not therefore act in reliance on any of the information presented here. We would always recommend that you consult with qualified professionals with specific knowledge of your circumstances before proceeding (for example: a solicitor, surveyor or accountant, as the case may be).