First-time buyer lands dream village home at auction.

It’s little wonder that Vickylee Cain, a 42-year-old self-employed farm auditor, fell in love with the peaceful and picturesque village of Wonston, a haven in the Hampshire countryside. With its stunning scenery and quaint homes, Vickylee had her heart set on settling down in the area.

The idea

Local properties routinely sold for over £610,000 in Wonston, near Sutton Scotney, and Vickylee felt priced out – a common feeling for first time buyers. However, like an increasing number of people still aspiring to own their own homes, Vickylee decided to take action.

She said, “I’d never really considered buying at auction before, but knew I’d never be able to afford a property in such a desirable area otherwise.”

“I’d looked on a couple of auction websites over a few months and even put a bid on another house – and was outbid - before I found this one.”

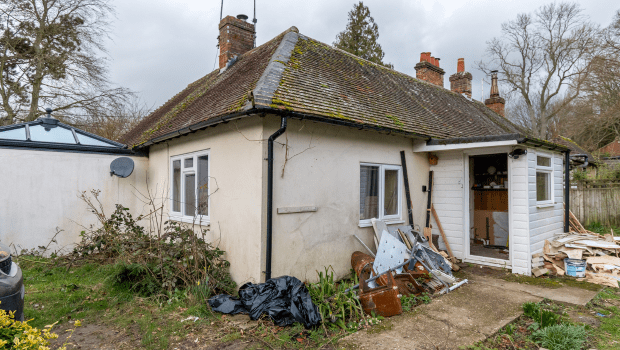

The property was a run-down two-bedroom bungalow, in need of extensive remodelling, but Vickylee could clearly see that it had character and potential. Importantly, the building was within budget, even with renovation costs, and ideally located in the village.

The enablement

Before the auction, Vickylee spoke with both Together and a high street lender to secure the funds that she needed to bid with confidence. It was bad news from the high street lender, who refused to help due to the property having an issue with damp, and no working bathroom. Additionally, being self-employed with an irregular income added to their list of criteria against the application.

When Vickylee spoke to Together, she explained that she would fix up the property before moving in. We looked at her individual circumstances instead of criteria – a common-sense approach that allows us to lend on non-standard properties and in cases with irregular income streams or credit history.

After securing a £50,000 mortgage from Together, Vickylee was able to put in the winning bid of £171,000 on her dream home.

Thanks to the speed at which Together were able to provide the funding, she was also able to complete the purchase well within the 28-day completion period required on auction properties.

The future

Currently renovating the bungalow, Vickylee said, “Buying a house like this was always a dream project of mine. At the moment, it’s just a shell. There're no walls or anything, so it’s quite overwhelming. But when it’s done, it’s going to be a cute little cottage with a vegetable patch and loads of outdoor space.”

A longer term loan of 25 years allowed Vickylee to focus her budget on the remodelling the cottage, allowing her to craft the perfect home for her and dog, Sherbie, all set in this idyllic locale.

Director of Auction Finance at Together, Scott Hendry, commented, “Auction is a great place for buyers to find hidden gems at much more affordable prices. Yes, some will be in a less than perfect condition. And, yes, there are costs involved in renovation. But, if you aren’t afraid of a little hard work and the cost of improvements is within your budget, you can find your dream home for less and add value to it easily. As the old saying goes ‘Buy the worst house on the best street’, and it’s never been more true.”

With getting on the property ladder becoming an ever more distant dream for many, the combination of buying at auction and flexible lending could make homeownership affordable and achievable again. Speaking about her dream home and future, Vickylee reiterated, “It’s just something that I would never have been able to have done otherwise.”

We’ll be back to visit Vickylee (and Sherbie) again soon to see her progress turning the dilapidated into the delightful.

Want to learn more about bidding at auction? Check out our top tips videos where our team of auction finance experts share their experience and knowledge so you can bid with confidence.

Any property, including your home, may be repossessed if you do not keep up repayments on your mortgage.

All lending decisions are based on lending criteria and, where applicable, subject to credit check and an assessment of individual circumstances.

All mortgages are subject to our terms and conditions.

Loans offered by Together Commercial Finance Limited are not regulated by the Financial Conduct Authority.

Articles on our website are designed to be useful for our customers, and potential customers. A variety of different topics are covered, touching on legal, taxation, financial, and practical issues. However, we offer no warranty or assurance that the content is accurate in all respects, and you should not therefore act in reliance on any of the information presented here. We would always recommend that you consult with qualified professionals with specific knowledge of your circumstances before proceeding (for example: a solicitor, surveyor or accountant, as the case may be).